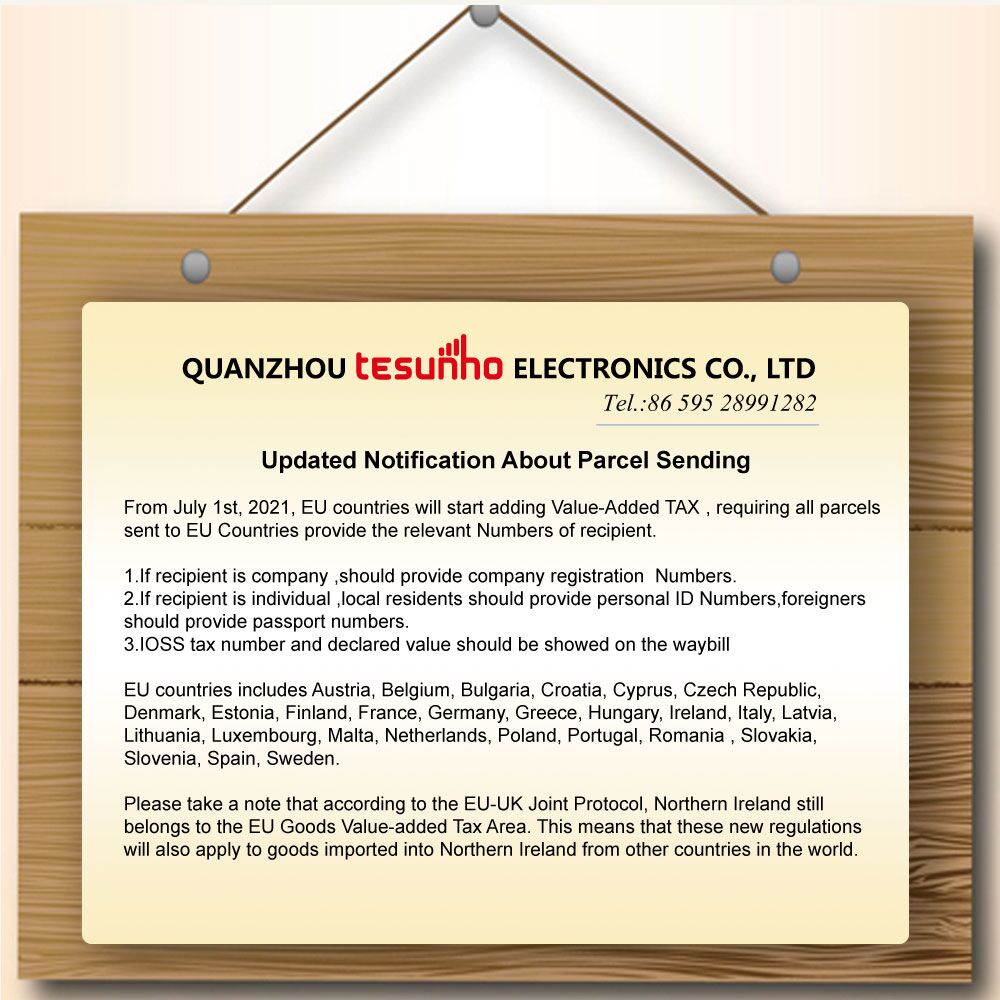

From July 1st, 2021, EU countries will start adding Value-Added TAX , requiring all parcels sent to EU Countries provide the relevant Numbers of recipient.

1. If recipient is company ,should provide company registration Numbers.

2. lf recipient is individual local residents should provide personal ID Numbers,foreigners

should provide passport numbers.

3.IOSS tax number and declared value should be showed on the waybill.

EU countries includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic,

Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania , Slovakia,- Slovenia, Spain, Sweden.

Please take a note that according to the EU-UK Joint Protocol, Northern Ireland still

belongs to the EU Goods Value-added Tax Area. This means that these new regulations will also apply to goods imported into Northern Ireland from other countries in the world.